Consolidation

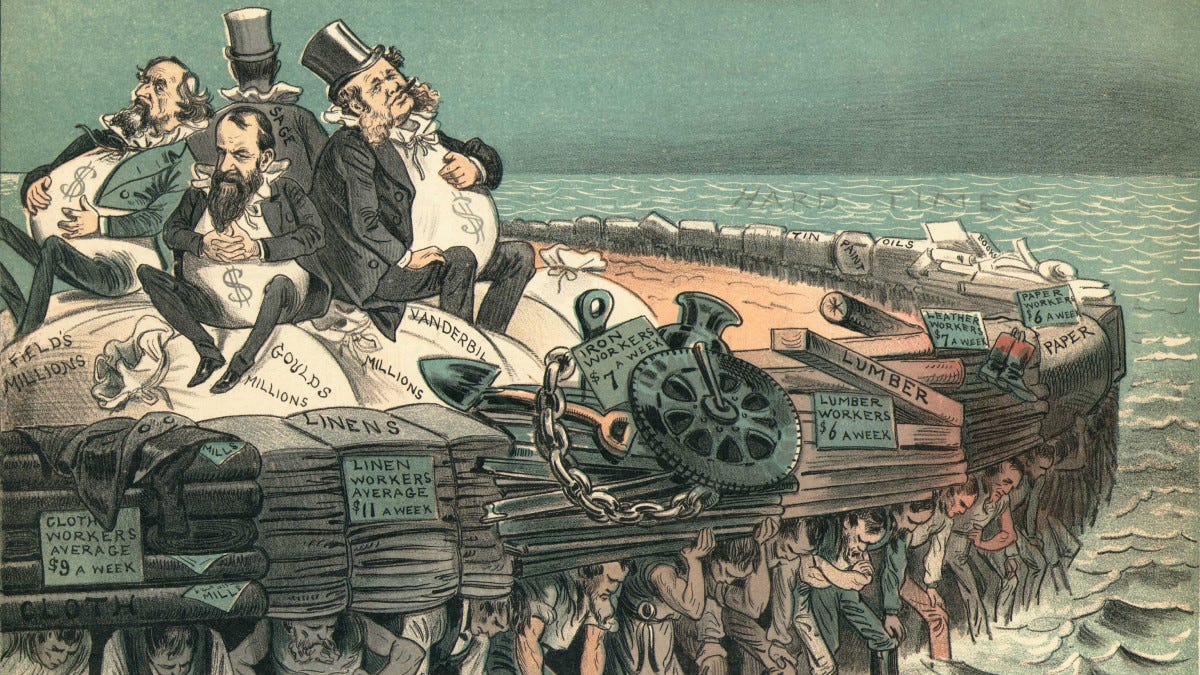

(Image at the top of History.com article Are We Living in the Gilded Age 2.0?)

The other pattern of consolidation that has turned up repeatedly in my career is amalgamation. If you want to grow your business, buying competitors is easier than beating them in the market. In one swoop, buying a competitor gets them out of your way, converts their resources into additions to your resources, and increases your share of the market. From your perspective as a business magnate in the making, what’s not to like?

From the market’s perspective, this type of consolidation can be good, neutral, or bad… sometimes terribly bad.

It can be good when a well-run company absorbs competitors that are struggling, maybe failing, maybe wreaking havoc in their floundering efforts. In that case, getting acquired by the well-run company is salvation and relief.

It can be neutral when acquired businesses aren’t very different in quality and aren’t big enough for the combination of resources to affect market dynamics very much.

But sometimes consolidation results in market domination. For a while it may seem okay. The business that has grown to become a giant in its market may seem like it’s exactly what everyone needed, a beneficial force. Even if it has benevolent intentions early on, that won’t last. In its field, it has become a monopoly, an apex predator. Any upstart going up against it is either eaten or crushed.

A monopoly also mangles its market. It is the proverbial 800 pound gorilla, powerful enough to do what it wants and shrug off any effort to constrain it. The market gets what the monopoly wants to provide, regardless of whether that is what the market wants or needs. The market has to pay as much as the monopoly wants to charge, regardless of whether or not the price is reasonable. Monopolies can engage in corrupt practices with impunity, and eventually often do.

Ultimately you and I are the market, at the mercy of a beast that runs rampant unless and until it is caged by something bigger.

This has happened over and over. Monopolies are a key element of how wealth is extracted from those who aren’t in the elite, then funneled upward to the elite. When the concentration of wealth becomes intolerably skewed, something big happens. (See my previous mentions of Thomas Piketty’s data if you want to see evidence. Disclosure: That’s an affiliate link.)

Although it’s often war or revolution, it doesn’t have to be. Government reforms, regulation and enforcement can rein in rampaging monopolies. The end of the Gilded Age was a huge step in that direction. The imbalance had become too extreme and too global for that to be enough. Rebalancing continued through two world wars and the Depression of the 1930s. But the way the Gilded Age met its end can serve as a model for how to rebalance without so much trauma.

Not being a historian and not having the space of an entire book here, I’ve danced lightly through the headlines of the subject. But it’s worth noting how often we’re seeing bad news that traces to companies which dominate or at the least have a large percentage of their markets.

At the moment, in the USA the latest surge of such news is about baby food. That industry has consolidated so much, it is dominated by a small handful of companies. Production problems at one of those companies caused a huge disruption in supply.

Globally, the major integrated oil companies and a handful of nations dominate the market. The wholesale price of raw materials is high, but not stratospheric. Oil companies have used wholesale price increases to levy significantly larger price increases on customers, increasing their profit margins. Retail prices have jumped enormously, inflicting severe economic pain on people and businesses around the world while oil companies rake in stunningly high profits.

Those are only a couple of examples. Look at the news. You can find plenty more.

Consolidation is a common business growth strategy. Market domination is considered by many business people to be a desirable goal. But eventually that distorts and destabilizes markets. Like many things, consolidation can be good in moderation, but becomes bad when taken to excess.

An endless appetite for growth and domination is ultimately unhealthy. Businesses that carry on for centuries don’t go there. A few are in the USA, and more in the Old World. Those businesses sometimes become big in their market, but they stop short of swallowing it all. If you want your business to be a legacy, that’s the highest aim. Not a colossus bestriding it all, just big enough.