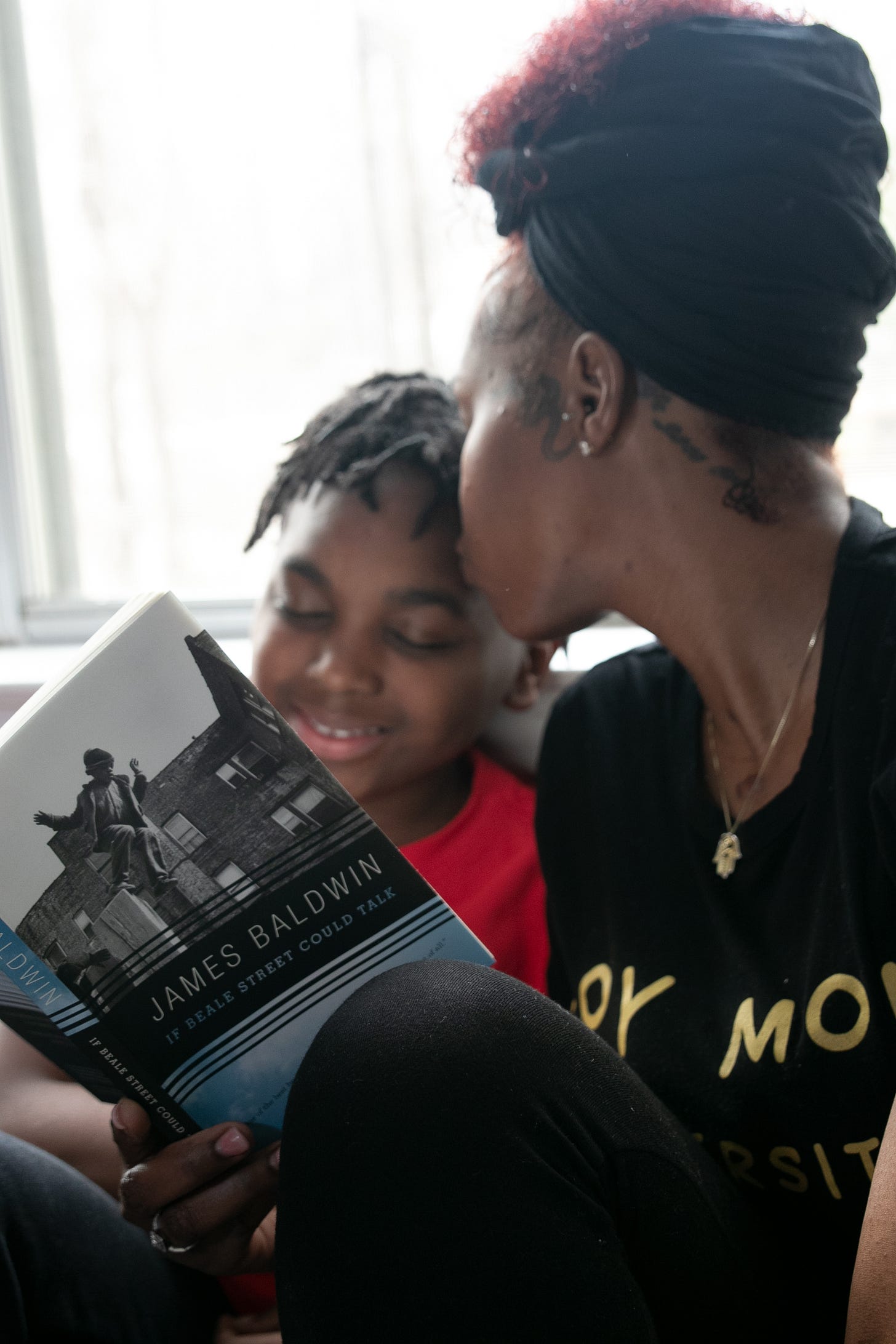

(Photo by Michael Williams Astwood at Scopio)

You may have noticed I don’t regard money as the factor that should drive all decision-making. I’ve talked about this in regard to our solar power system. It also applies to home ownership.

One of my closest business associates likes to rant that it is stupid for most Britons to want to own their home. Even though real estate prices have escalated dramatically during his lifetime, he rants that home ownership isn’t really a very good financial investment. Other investments are available to gain value faster and more easily convert into cash. What good is it to own a home that has gained in value when generally you can’t use that value for living costs?

He carries on in this vein at great length.

While he rants, I notice that he and his wife fully own their house and the sailboat on which they spend half the year now that they are semi-retired. They aren’t renting.

He has missed the point. People who have a house may talk about how much its market value has gone up, but for many people owning your home isn’t mainly about financial investment.

USA versus UK Relocations

Before moving here, for about 15 years an unwritten law of the universe put each contract I landed at least 1000 miles from the one before it. I hardly ever have a job. I have contracts. The nature of my skills has always meant that no single place is likely to have enough need for me all the time, so if I work onsite, I’ve had to go wherever the need happens to be at the moment. Sometimes I moved three times in a year, or with some luck I could stay in one place for a couple of years. On average, I moved once a year. My total cost to relocate was $800 to $1500 each time, even across the country.

Americans can readily do that if needed. It isn’t practical in the UK. The land mass is only about the size of Michigan, but the way things are done makes relocating a Herculean task at the pace of molasses in January.

Until the past few years when I began working almost exclusively from home, work in the UK was still spread around the country. People here seldom relocate to get closer to their worksite.

Buying

In the USA, it’s possible to sell or buy real estate quickly. I’ve bought a property in as little as a month from start to finish without doing anything special to speed up the deal. Americans can and do sell a house and then buy another close to a new job.

In the UK, getting the house we’re in took 6 months. It was a shared ownership deal with no mortgage and no chain, so it looked like it should close (complete in British English) quickly. (UK real estate deals can be chained together with other deals, each dependent on completion of the one before it. If any deal in the chain hits a snag, the entire chain is blocked.) People have praised us for how fast our deal completion was. To me, six months seemed very slow.

Renting

You may think that surely renting would be the solution. In the USA, I usually rented an apartment near each contract site. Even if the local real estate market was attractive for investment and my contract was long enough, I wouldn’t try to buy as soon as I arrived.

Renting is not easy in the UK. Finding and securing a place to rent is slow, expensive, cumbersome and full of pitfalls. You can spend several hundred pounds in fees with a rental (letting) agency only to have them laugh and say too bad, they’ve decided not to rent to you. No, your fees are not refundable.

Are you a citizen, or not? Do you have a history of previous addresses that looks stable? What is your credit rating? How much money do you make? How much of your money do you spend? Do you have children or pets? Anything can knock you out of a chance at a rental.

From this glimpse, you can imagine how it all goes and understand why people are reluctant to try to relocate, even as renters.

Army of Commuters

Either way you look at it, for homeowners or for renters, relocating here is a huge costly snail-paced pain in the posterior. In the UK, an army of people travel from home to a bed & breakfast, guest house or hotel room every Sunday night or Monday morning, work through the week, then travel back home Friday evening. I didn’t even know this army existed until I became part of it.

In the weekly-commuter army, you’re trying to keep costs down. Unless you’re a C-suite executive of a prosperous company (yes, I know some of those who do the weekly commute), the places you stay in during the business week are contractor lodgings, not the lovely places a tourist would choose. The food you eat is whatever you can get cheaply, not nice dinners at restaurants.

Why put up with this? Because doing otherwise would give up on knowing you’ve got someplace to call home, someplace where you belong, someplace where you can feel sheltered and familiar. If you give up on having a home address and stay in contractor lodgings throughout a contract or job, it’s too damned hard to ever rent a place again due to the break in your address history, and the same break could be the detail that prevents you from getting a mortgage or a job. If you don’t have a steady home address, it can interfere with all manner of other things too. It’s used to verify that you are you and worthy of whatever you’re trying to do, regardless of whether that makes any sense.

What My Colleague Doesn’t See

Some people do buy their home as an investment they will live in while it appreciates in value. They may plan to pass it along to heirs or cash it in to fund a place in an assisted living facility.

But it’s very hard to predict how the world will change over 20 or 40 years. Not many people had the past 3+ years on their radar decades ago, as an example.

For most people, the main reason for wanting to own their home is the feeling of having it. We want to know we have a place to hang our hat, one where we have control over how issues are dealt with. If something leaks, we can fix it before black mold starts creeping in instead of helplessly watching the walls grow fuzzy while we plead for the landlord to make repairs. If we own instead of rent, we can paint the walls any color we want, put up pictures, install shelves and make changes.

If we get as far as paying off all the debt we took on to buy it (or in the case of my wife and me, buy out the other party in a shared ownership), we aren’t so much at the mercy of central banks raising interest rates. We just need to keep up with property taxes and basic operating costs of the place such as utilities.

There may be no such thing as perfect safety and security, but owning our home feels so much more secure than not owning it.

No other investment feels the same.

Things are quite different in the UK regarding rentals and home ownership. I'm fortunate I bought my modest Oklahoma home in July 2021 before the interest rates skyrocketed. After selling my Maine home in 2010 I vowed I'd never own another, because of the cost of maintaining and repairing. But rents across the country have skyrocketed as well, and investors are reducing the supply of single-family homes by turning them into AirBnBs or rentals. The little home I bought with my husband in Tacoma, Washington in 1979 for $30,000, and remodeled and sold for $45,000, is now valued on Zillow at $325,000. I am loving the investment of time and money towards making a native wildflower garden, and putting as many pictures on the walls as I want, and painting a yellow wall, and having a kitty cat. Having a place of one's own is worth much in peace of mind.